By Dadong Wan, Accenture Technology Labs Fellow, Accenture

One of the key findings from the recent World Economic Forum (WEF) report (in collaboration with Accenture) is that the Industrial Internet will have a disruptive impact on many industries. More importantly, such a disruption could happen within the next five years. So, what will be the nature of disruption, and what can companies do to best prepare for it?

One of the key findings from the recent World Economic Forum (WEF) report (in collaboration with Accenture) is that the Industrial Internet will have a disruptive impact on many industries. More importantly, such a disruption could happen within the next five years. So, what will be the nature of disruption, and what can companies do to best prepare for it?

The year-long research, which culminated with two successful CEO sessions during the 2015 Annual Meeting in Davos, has led us to conclude that the emergence of the outcome economy represents the most significant business opportunity in the years ahead. The WEF survey -- in which many Industrial Internet Consortium members participated -- also showed that only one out of ten organizations understands the full implications and is ready to capitalize on it.

So, what is the outcome economy? We can start with a salient observation once made by Harvard Business School professor Theodore Levitt, "People don't want to buy a quarter-inch drill. They want a quarter-inch hole!" In other words, in many cases products people buy are not the end in itself but rather a means to an end. Today, most product companies still focus their attention on functional features, quality, cost or services for their products. In an outcome economy, businesses will compete on their ability to deliver quantifiable results that matter to customers (i.e., the why behind the buy) rather than just selling individual products or services.

The Industrial Internet is a key in making outcome economy possible. Powerful connected sensors are making traditionally opaque physical activities or processes "digitally visible" in the form of continuous streams. Such data can then be analyzed to reveal the underlying patterns and modeled to produced optimal outcomes. So, companies that figure out how to leverage this new level of visibility into their business operations, product and customer behaviors, and outcomes will be the most likely to succeed.

Surprisingly, the two industries that are currently at the forefront of the evolution toward outcome-based services are also two of the oldest industries -- agriculture and healthcare. By connecting smart farm equipment such as tractors, tillers and seeders with geo-location data (e.g., weather, soil conditions) and advanced optimization software, agricultural companies like Monsanto, John Deere and Dow Chemical can now sell farmers guaranteed crop yield rather than individual products such as seeds, fertilizers and farm equipment. For example, John Deere and ARGO are working together to connect irrigation systems and soil and nutrient sources, with weather data, crop prices and commodity futures to optimize overall farm performance.

Similarly, medical device manufacturers are beginning to connect their products with clinical systems to deliver improved healthcare outcomes. For example, Jeroen Tas -- CEO of Philips Healthcare Informatics and Services, shared at Davos the early successes Philips has achieved with remote patient monitoring, which has led to the reduction of hospital readmission by about 50 percent in some cases, resulting in better care with lower overall cost.

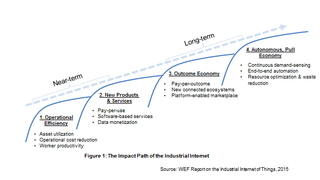

Evan as these industries lead the charge, it is important to recognize that we are still at an early stage in the evolution of the Industrial Internet and the future outcome economy. As shown in Figure 1, in the near term, the primary driver for adoption in many industries will remain on improving operational efficiency (e.g., improved uptime, asset utilization).

However, companies that wish to tap into the disruptive potential of the Industrial Internet need to evaluate how the shift to an outcome-based business model will transform their industry and their overall business strategy. In particular, they need to consider how their investment in operational efficiency and new products and services can also help set them up in an outcome-based marketplace. Because delivering customer outcomes require collaboration with players outside their own industries, companies may also want to reassess the current state of their ecosystem before deciding what capabilities to be built internally versus sourced from partners. Early market leaders such as GE, Philips and John Deer provide useful models for the rest of the industry.

To learn more about the outcome economy and other detailed findings from the WEF project, as well as what your organization can do to help accelerate the adoption of the Industrial Internet, I encourage you to read the full WEF report.

This post is Part One of a two-part blog based on the World Economic Forum's project on the Industrial Internet (in collaboration with Accenture). Special thanks to Derek O'Halloran -- Director and Head of Information Technology Industry, WEF; Paul Daugherty -- Chief Technology Officer, Accenture; Prith Banerjee -- Managing Director of Global R&D, Accenture; and Edy Liongosari -- Managing Director, Accenture Technology Labs.